Bank Reconciliation Audit Procedures: Your 7-Step Guide to Flawless Financials

34% of companies report financial discrepancies because their bank reconciliations were insufficient. A missing transaction or an unrecorded fee can result in mortgaging cash flow and impact compliance which leads to expensive mistakes.

This is where a bank reconciliation audit steps in, not as a mundane checklist, but as a critical shield protecting your organization’s financial integrity.

Understanding how to audit bank reconciliation statements is essential.

In this guide, we’ll break down the 7 bank reconciliation audit procedures used by experts to detect errors, prevent fraud, and ensure every dollar is accounted for.

No jargon, no fluff, just actionable insights you can implement today.

What is a Bank Reconciliation Audit? (And Why It’s Not Optional)

A bank reconciliation audit compares your internal financial records against bank statements to verify accuracy. Think of it as a financial “fact-check” that answers one question: Do our books reflect reality?

While audits are invaluable, they’re not foolproof. Discrepancies can still slip through, which makes regular bank reconciliations essential. They come with their own advantages and disadvantages, but their role in maintaining financial accuracy is undeniable.

The Importance of Bank Reconciliation Audit

- Fraud Detection: The Association of Certified Fraud Examiners reports that 29% of fraud cases involve asset misappropriation, often caught during reconciliations.

- Error Prevention: Bank fees, interest adjustments, or data entry mistakes frequently slip through the cracks.

- Regulatory Compliance: Auditors and tax authorities demand precise records. A single inconsistency can trigger audits or penalties.

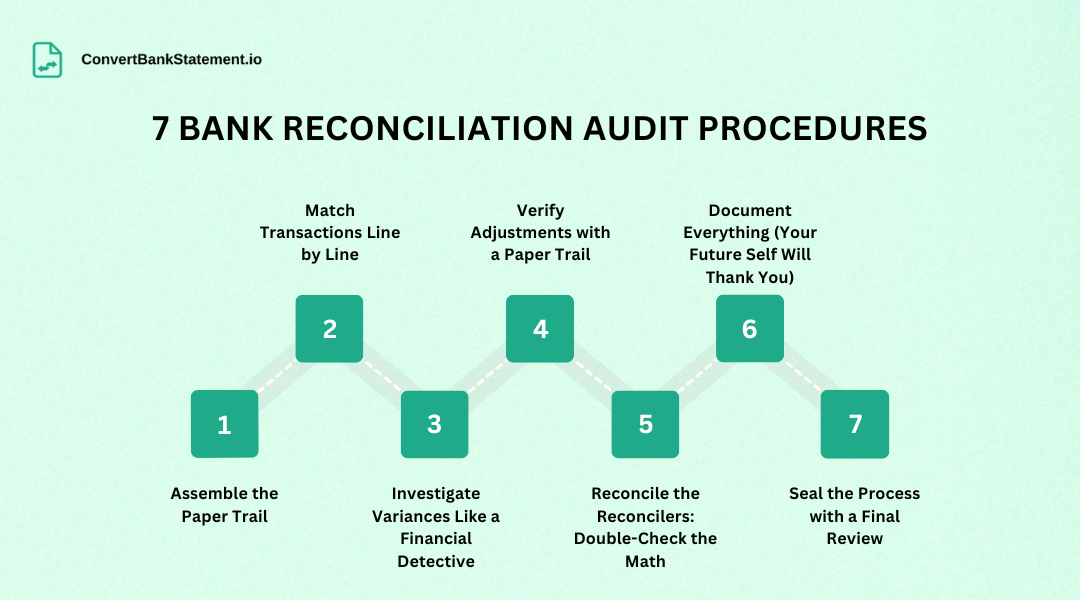

7 Bank Reconciliation Audit Procedures to Eliminate Financial Blind Spots

1. Assemble the Paper Trail

Documents you can’t afford to miss.

Start by gathering:

- Bank statements (printed and digital copies)

- Internal cash ledgers or accounting software reports

- Deposit slips, cancelled checks, and electronic transfer records

- Previous reconciliation reports for comparison

Pro Tip: Use a secure cloud platform to organize documents. Missing a single deposit is a red flag for auditors.

2. Match Transactions Line by Line

Compare each entry in your ledger against the bank statement. Common red flags can include:

- Timing Differences: Deposits in transit or outstanding checks

- Amount Discrepancies: A $500 check was recorded as $50? Common manual error

- Unrecorded Items: Missed bank fees, interest income, and direct debits

3. Investigate Variances Like a Financial Detective

Not all discrepancies are errors. Categorize them:

- Legitimate Timing Gaps: Checks have not yet been cleared (record them as “outstanding”)

- Human Errors: Transposed numbers/duplicate entries

- Suspicious Activity: Unauthorized withdrawals/forged checks

4. Verify Adjustments with a Paper Trail

Every adjustment (e.g., recording a bank fee) needs proof:

- Signed approval from a manager

- Supporting documents (e.g., bank fee notifications)

- Notes explaining the reason for the adjustment

Unsupported adjustments are a hallmark of fraudulent activity.

5. Reconcile the Reconcilers

Even experts make calculation errors. Use these safeguards:

- Two-Person Verification: One prepares the reconciliation; another reviews it

- Automated Tools: Software like QuickBooks auto-matches transactions

- Reverse Reconciliation: Start from the prior month’s ending balance and work forward

6. Document Everything (Your Future Self Will Thank You)

Create an audit trail that answers:

- Who performed the reconciliation?

- What discrepancies were found?

- How were they resolved?

- When was it reviewed/approved?

7. Seal the Process with a Final Review

Before signing off:

- Confirm the adjusted balances match

- Ensure all supporting documents are attached

- Schedule the next audit (monthly/quarterly)

Pro Insight: Companies that reconcile monthly reduce error resolution time by 68%.

Common Pitfalls to Avoid:

- Relying solely on automated tools without manual checks

- Letting low-risk accounts slide (“Small balances matter!”)

- Failing to train staff on updated procedures

Final Thoughts:

A bank reconciliation audit isn’t just about compliance, it’s a strategic lens into your financial health. By adopting these 7 procedures, you’ll not only catch errors but also uncover insights into spending patterns, cash flow bottlenecks, and operational inefficiencies.

Ready to streamline your process? Explore ConvertBankStatement.io which transforms chaotic statements into audit-ready clarity.