Did you know that 85% of banking professionals report manual data entry as their primary operational bottleneck? The speed and accuracy of operation set the competitive standards. Thus, OCR technology has redefined the methods in which companies work with bank statements.

OCR bank statements bring a real revolution for finance teams buried in paperwork. In this guide, we will explain how OCR improves banking workflows, reduces errors, and provides actionable insights, all while remaining human-centered and operationally lean.

What is an OCR Bank Statement?

An OCR bank statement is a digital version of a paper statement. Any PDF or image that is OCR scanned is converted into searchable text. It automates data extraction, converting transaction details into formats such as EXCEL, CSV, or JSON for easy processing.

OCR technology helps read bank statements by extracting text from images or PDFs.

OCR identifies letters, numbers, and symbols using pattern recognition.

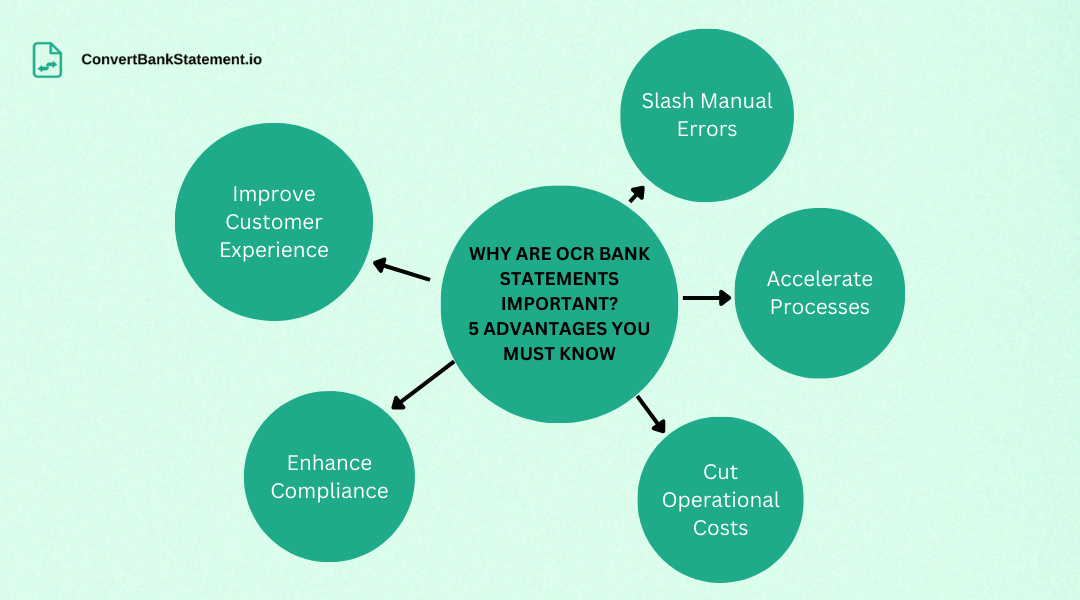

Why is an OCR Bank Statement Important? 5 Advantages You Must Know

- Reduce Manual Errors: Humans are prone to typos, but OCR achieves 99% accuracy in data extraction, which reduces costly mistakes in financial reporting.

- Accelerate Processes: Tasks like loan approvals, which once took weeks, now take minutes. OCR automates data entry. This assists teams to focus on strategic decisions.

- Cut Operational Costs: Banks using OCR report 70% lower processing costs by minimizing manual labor and paper-based workflows.

- Enhance Compliance: OCR automatically flags discrepancies (e.g., mismatched account numbers), which simplifies audits.

- Improve Customer Experience: Real-time data access keeps clients happy. A bank can process applications in just 60 seconds, thanks to OCR technology.

Real-World Use Cases of OCR

- Loan Processing: Extract income details, transaction histories, and credit scores from PDFs to pre-fill application systems.

- KYC Verification: Validate IDs, utility bills, and passports in seconds during customer onboarding.

- Fraud Detection: Scan transaction patterns to flag anomalies like duplicate payments or suspicious withdrawals.

- Financial Reporting: Automatically compile monthly statements into dashboards for CFO reviews.

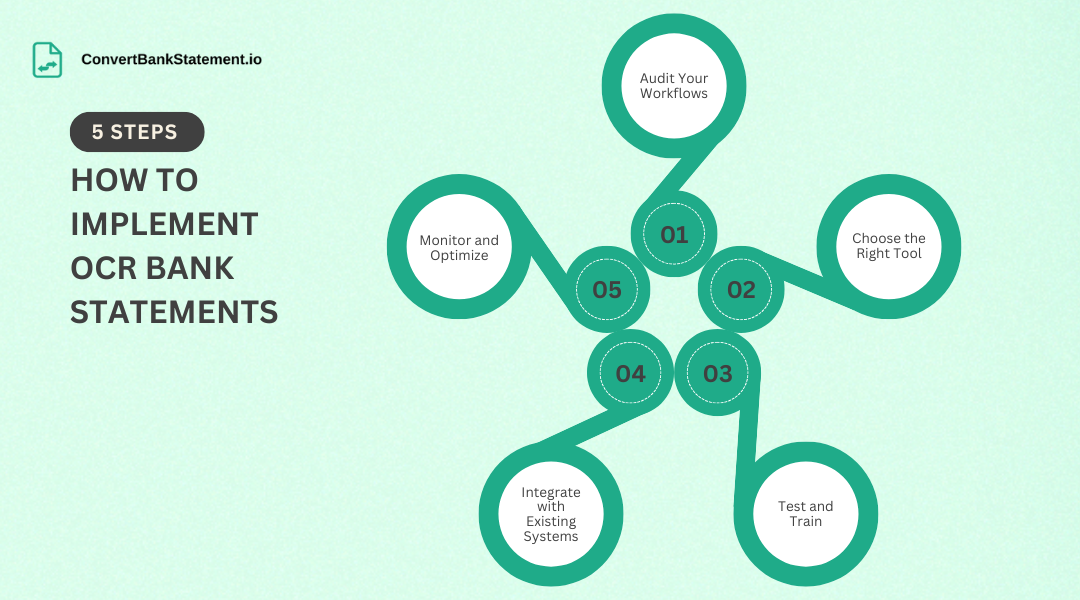

How to Implement OCR Bank Statements: A Step-by-Step Guide

- Audit Your Workflows: Identify pain points, like slow customer onboarding, where OCR can add value.

- Choose the Right Tool: Look for solutions that handle both structured (PDFs) and unstructured (handwritten notes) data.

- Test and Train: Run pilot tests with sample documents. Train your team to use OCR outputs effectively and emphasize that the tool complements rather than replaces their expertise.

- Integrate with Existing Systems: Ensure OCR software syncs with your CRM, accounting tools, or legacy systems to avoid data inefficiencies.

- Monitor and Optimize: Track metrics like processing speed and error rates. Refine workflows based on feedback from staff and clients.

3 Common Challenges (and How to Solve Them)

- Scanning: Use AI-powered OCR tools that learn from context, even deciphering faded ink or cursive writing.

- Data Security: Opt for platforms with encryption, role-based access, and GDPR compliance.

- Automation: Highlight OCR’s time-saving perks. Show teams how automation lets them focus on creative tasks.

Future-Proof Your Finance Workflows

The OCR market is anticipated to grow to $13.38 billion by the year 2025. Banks that do not respond to this shift will jeopardize losing customers to technology-savvy competitors in the future of fintech.

OCR bank statements do more than just digitize information; they build the groundwork for more intelligent, AI-driven insights and personalized banking experiences. They can provide instant data extraction through OCR.

Most manual work and human errors can be avoided as much as possible with OCR. AI-enabled analytics will handle a considerable amount of work for organizations, whether it's identifying spending patterns, detecting fraud, or predicting cash flow.

Automated forecasting is done to better prepare businesses for financial risk avoidance as well as budgeting. Even personalized banking services, such as rapid budgeting and individually tailored investment recommendations, can be enhanced with AI.

Conclusion

OCR bank statements are no longer optional; they have become essential for businesses that want to remain competitive; manual entry is slow, can be prone to errors, and is costly. OCR turns that very static PDF into structured, actionable data in a matter of seconds.

This translates to faster approval, less error, and smarter financial decision-making. AI-enabled analytics can detect fraud, predict cash flow, and offer personalized financial services.

Customer experience will improve because of real-time exposure to financial data, while compliance issues may be simplified.

As the global OCR market grows, early adopters will lead the way. Platforms like convertbankstatement.io make implementation seamless. The future of finance is digital, start using OCR now to future-proof your business.