Effective financial management starts with tracking income and expenses. But beyond simple tracking, a more powerful approach is categorizing bank transactions in Excel. This makes expense management much easier.

We’ll explain to you how to import bank transactions into Excel, set up categories, and automate the process to systemize your finances.

Why Transactions’ Categorization Matters?

Categorizing the transactions can make you able to:

- Identify spending patterns (for example, “What made my coffee budget triple last month?”).

- Ease the preparation of taxes by consolidating deductible expenses.

- Detect errors by establishing a clear audit trail.

- Create a workable budget after analyzing real data.

- Get rid of the guesswork and control your finances.

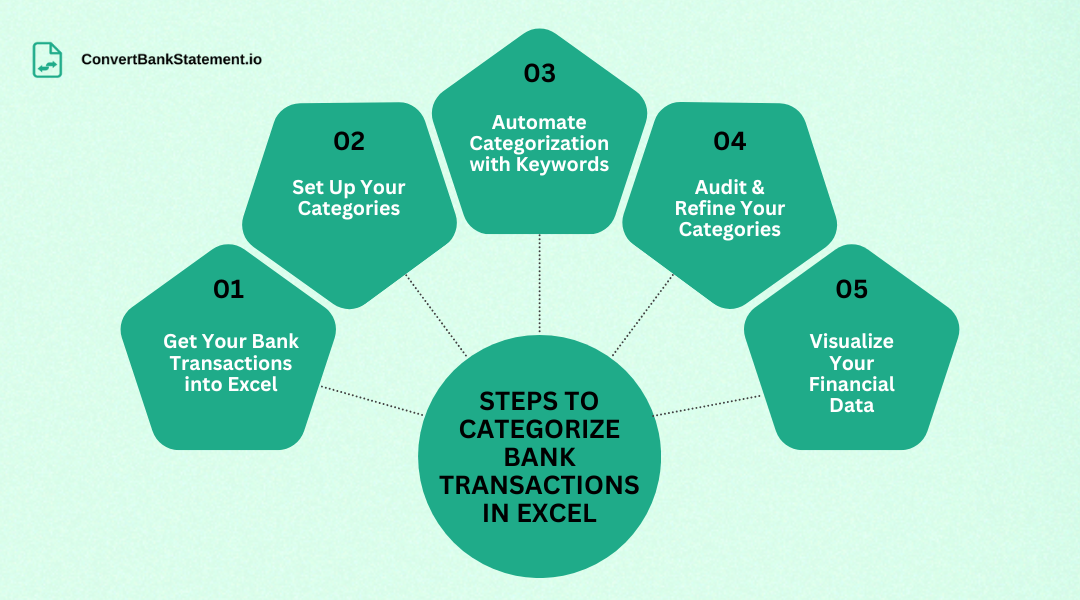

Steps to Categorize Bank Transactions in Excel

Step 1: Get Your Bank Transactions into Excel

You need data for categorization. Here are simple steps to import transactions.

Download a CSV File Directly From Your Bank

Almost all major banks (Chase, Bank of America, etc.) allow downloading bank statements in CSV format so that they can be easily imported into Excel. To download the CSV file, follow the below process:

- Log into your online banking portal

- Navigate to “Account Activity” or “Statements.”

- Choose a date range and download the CSV

- Open it in Excel, no formatting is needed

Pro Tip: Rename the file with the month/year (e.g., “May-2024_Transactions”) to avoid confusion later.

Convert PDF Statements to Excel

If your bank only provides PDF statements, use a dedicated tool like convertbankstatement.io to convert it into Excel.

Here’s why:

- Accuracy: It converts complex PDF tables into clean Excel sheets without messing up numbers

- Speed: You can process statements having 100+ pages within seconds

- Security: Unlike free online tools, your data isn’t stored or shared

How to Use ConvertBankStatement.io:

- Upload your PDF statement

- Select “Excel/CSV” as the output format

- Download the file and open it. Transaction dates, descriptions, and amounts will be neatly organized in it.

Manual Entry

Only do this if you have <20 transactions. However, double-check every digit. A typo like “$500” vs. “$50.00” could impact your budget.

Step 2: Set Up Your Categories

Set up categories as labels for your transaction distributions. Common ones include:

- Income: Salary, freelance payments, dividends

- Fixed Expenses: Rent, utilities, subscriptions

- Variable Expenses: Groceries, dining, entertainment

- Savings/Investments: Emergency fund, retirement contributions

Customize based on your needs:

- A freelancer might add “Tax Withholdings” or “Client Reimbursements.”

- A family could use “Kids’ Activities” or “Pet Care.”

Step 3: Automate Categorization with Keywords

Manually tagging each transaction is tedious. Let Excel work smartly with keywords:

- Add a “Category” column next to your transaction list

- Use the `=IF(ISNUMBER(SEARCH()))` formula to auto-tag transactions

Example:

- To label all Amazon purchases as “Shopping”:

=IF(ISNUMBER(SEARCH("Amazon", B2)), "Shopping", "") ``` (Where B2 is the cell with the transaction description.)

- Create a master keyword list in a separate sheet.

- Category: Keywords

- Utilities: Electric, Water, Gas

- Dining: Starbucks, McDonald's

- Software: Adobe, ConvertBankStatement

Step 4: Audit & Refine Your Categories

Automation isn’t foolproof. A few quirks to watch for:

- Overlapped keywords: “Blue Ridge Water” (Utilities) vs. “Blue Ridge Café” (Dining)

- Generic terms: “Credit” could mean a refund or a bank fee reversal

Fix: Add exceptions using `=IF(AND())` statements. For instance:

=IF(AND(ISNUMBER(SEARCH("Credit", B2)), NOT(ISNUMBER(SEARCH("Fee", B2)))), "Refund", "Bank Fee")

Review uncategorized transactions weekly to catch any errors.

Step 5: Visualize Your Financial Data

Turn raw data into insights with Pivot Tables:

- Highlight your transaction range

- Go to Insert > PivotTable

- Drag “Category” to Rows and “Amount” to Values

Now you can see:

- Which category consumes 40% of your income

- Seasonal trends (e.g., higher utility bills in winter)

Common Mistakes (And How to Avoid Them)

- Overcomplicating Categories: Start with 5-10 broad buckets. Add subcategories later.

- Ignoring Cash Transactions: They’re easy to forget but can skew your budget.

- Not Backingup Data: Save your Excel file to Google Drive or OneDrive.

FAQs

1. What are the usual transaction categories in a bank?

These include:

- Income: Salary, dividends, etc.

- expenses: Groceries, utility bills, rent, etc.

- Savings and investment: Taxes, healthcare, and entertainment.

Is there a way to automate the categorization of transactions on Excel?

You can use VLOOKUP or INDEX and MATCH in Excel coupled with specific keywords assigned to each category to classify transactions according to the specified words or other criteria in the transaction data for those transactions.

3. What can one do with transactions fitting into two or more categories?

For those transactions fitting into one subcategory or another, create further subcategories or give it the major category that best fits its top-line purpose. Always be consistent in making rules defining how exactly to treat such transactions within the same categories to ensure all your records follow the same building principle.

4. Can I use Excel to generate reports based on categorized transactions?

Yes, once transactions have been categorized, Excel can generate reports using its PivotTable and Pivot Chart functionalities, thus enabling analysis for expenditure per category, tracking trends of spending, or any financial data analysis.

5. How often should I update and review my transaction categories?

It would be better to do the review for transaction categories regularly, whether monthly or quarterly. Periodic review could maintain their relevance and reflect your financials appropriately in your transactions for effective budgeting.

Conclusion

You can manage bank transactions in Excel with ease. Start by importing them, then categorize each one. Use formulas to automate the process and save time. This makes tracking expenditures and budgeting much clearer. Whether for personal or business use, organizing transactions in Excel keeps check and balance of your finances.