Fake Bank Statements: How to Spot Them?

Fake bank statements are fraudulent documents prepared to misrepresent financial truths. People prepare these documents to overstress their income, obscure their difficulties, or qualify for loans, rental purposes, and visa applications. Some manipulate statements from scratch, while others alter real ones using editing software.

To detect fake bank statements, check for formatting inconsistencies, unrealistic transactions, and discrepancies in account details. Bank institutions use advanced verification tools, but anyone can learn to identify fraud with the right techniques.

This blog post explains how to spot fake bank statements, the risks involved, and ways to ensure document authenticity.

What is a Fake Bank Statement?

A fake bank statement is a modified version of a real one.

There are two types of fake bank statements:

- Completely Fake Statements: Fraudsters create these from scratch using design software. They try to copy a bank’s official format but often leave behind clues that reveal the forgery.

- Tampered Statements: A person takes a genuine bank statement and alters details such as account balances, transaction histories, or personal information. These modifications are harder to detect but still leave traces of manipulation.

These documents can deceive landlords, financial institutions, immigration officers, and even businesses. However, careful inspection can reveal their true nature.

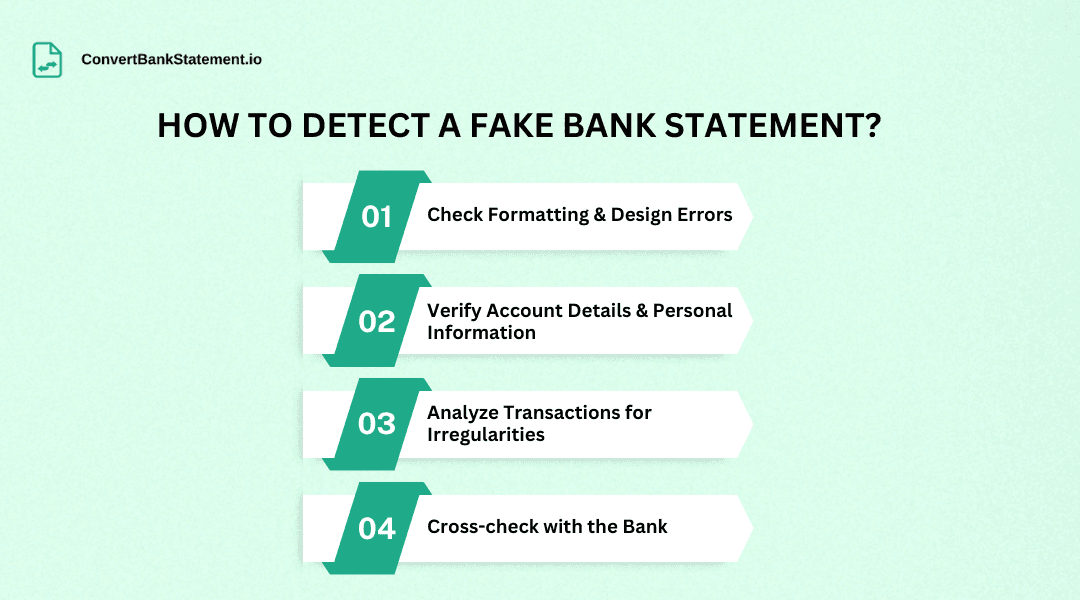

How to Detect a Fake Bank Statement?

Identifying a fake bank statement requires a keen eye and a systematic approach. Here are some of the most effective ways to spot inconsistencies:

1. Check Formatting

A real bank statement follows a consistent format, including font styles, spacing, and alignment. Any inconsistencies indicate potential fraud.

- Look at the Bank Logo: Fraudsters often use outdated logos or incorrect color schemes. Compare the statement with an official one from the bank’s website.

- Check the Font Style: Banks utilize specific fonts for their statements. If the font looks off or varies throughout the document, it’s likely fake.

- Alignment Issues: Authentic statements maintain uniform spacing. If you see uneven text placement, misaligned figures, or inconsistent margins, it suspects forgery.

2. Verify Account Details

Fraudsters often make mistakes when entering account details. Cross-check information carefully.

- Account Number Format: Every bank follows a specific format for account numbers. If the format doesn’t match other statements from the same bank, it’s a red flag.

- Compare Personal Details: Ensure the account holder’s name and address match official records. Any incorrect address suggests manipulation.

3. Analyze Transactions for Irregularities

Transaction history can reveal a fake bank statement quickly. Look for unusual patterns.

- Rounded Transactions: Real bank statements rarely show transactions in perfect round numbers. If you see too many rounded figures (e.g., $1,000.00, $5,000.00), the document may be fake.

- Sudden Spikes in Account Balance: Fraudulent statements may show large deposits or withdrawals that don’t align with regular transactions.

- Repeated Transactions: Look for duplicate transactions with the same amount and date. Fraudsters sometimes copy and paste transactions to make a statement appear genuine.

4. Cross-check with the Bank

If you suspect a fake document, verify it directly with the issuing bank. Banks offer bank statement verification services to confirm authenticity.

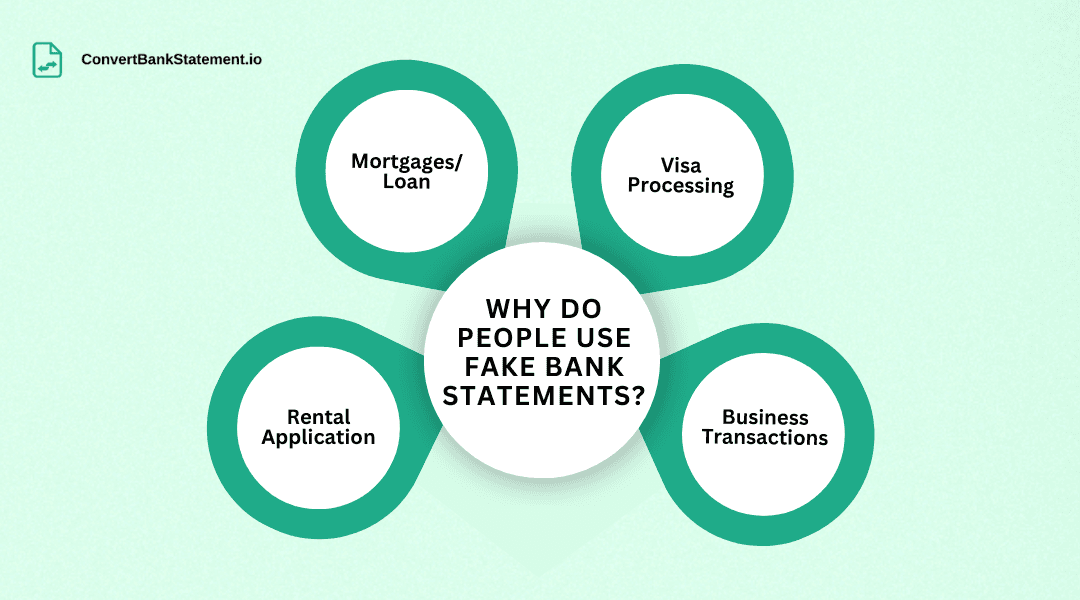

Why Do People Use Fake Bank Statements?

Fake bank statements are resorted for several purposes, such as:

- Mortgages/Loans: Applicants sometimes inflate their income to make themselves eligible for a loan or mortgage.

- Visa Processing: Immigration authorities reject the approval of applications without the verification of the applicant's stability in finances. Fraudsters go to the limit to forge bank statements to fulfill these requirements.

- Rental Application: Landlords request bank statements to ascertain a tenant's capacity to pay rent. Some tenants falsify such documentation to get a rental property.

- Business Transactions: Companies make fake financial statements to present themselves as profitable and attract investments.

Risk of Using a False Bank Statement

Submission of fake bank statements might cause severe legal consequences.

- Legal Liabilities: It is an offense under criminal law in either country to falsify financial documents. A person can be liable for court fines, lawsuits, or even imprisonment under various statutes.

- Blacklisted by Banks: Banks are keen on tracking frauds, and all persons are subjected to blacklisting if found guilty. This can prevent them from future financial transactions.

- Reputational Damage: Whether an individual or a business, getting caught using fake statements can destroy credibility and trust. No short-term gain is worth the long-term damage of financial fraud.

Tools & Methods to Detect Fake Bank Statements

Organizations and individuals can use various tools to verify bank statements.

Digital Verification Tools

Modern technology makes it easier to detect fake bank statements through digital verification. Bank institutions use OCR-powered software to analyze document metadata, fonts, and tampering signs.

Manual Cross-Checking

If digital verification tools aren’t available, a manual review can still catch many inconsistencies. Compare the document with a genuine bank statement.

Request a Certified Bank Statement

For important transactions, always request a certified bank statement directly from the bank instead of accepting self-submitted copies.

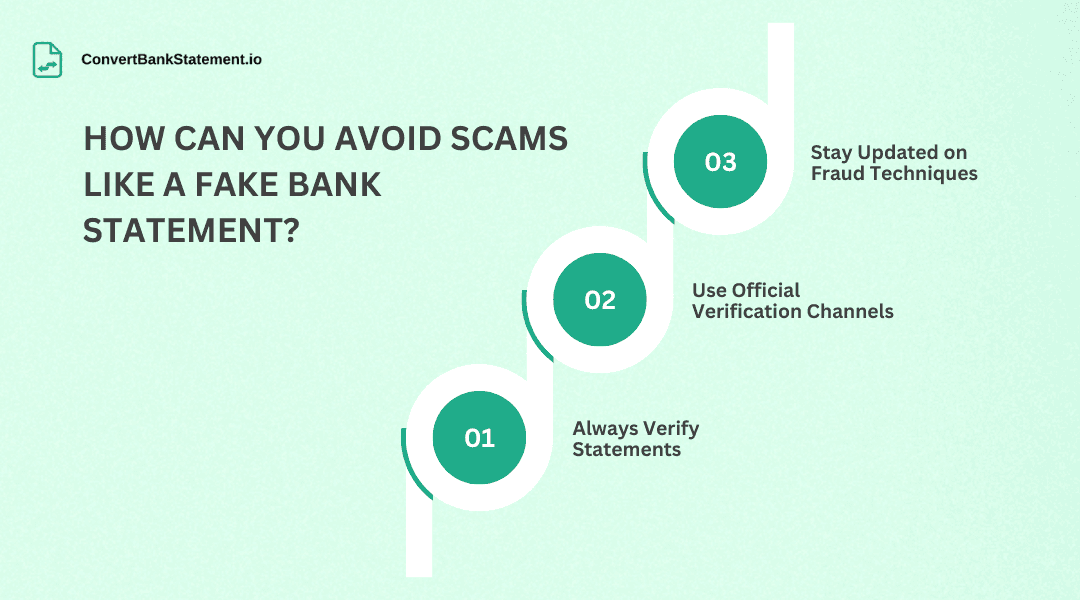

How Can You Avoid Scams like a Fake Bank Statement?

Whether you are a lender, employer, or business owner, there is always a way to stay ahead of fraud.

Always Verify Statements

Cross-check the provided statement with other financial records such as financial statements, tax returns, or payslips to ensure consistency.

Use Official Verification Channels

Whenever possible, contact the bank directly to verify a statement’s authenticity. Many banks provide online verification tools.

Stay Updated on Fraud Techniques

Fraudsters continuously refine their methods. Staying informed about new forgery techniques helps detect fake statements before they cause harm.

FAQs

1. How does a bank catch a fake bank statement?

The banks check with the help of document verification tools like OCR and AI-based fraud detection systems that check for fonts, metadata, and the integrity of the document. They also check transaction details against their records and verify them directly with internal records.

2. What are common signs of a fake bank statement?

The most common signs include:

- Inconsistent font styles and spacing

- Rounded transaction figures

- Repeated or unusual transactions

- Incorrect account number format

- Outdated or incorrect bank logos

3. How can landlords verify bank statements from tenants?

Landlords should request a certified bank statement directly from the bank or use official verification services. They can also compare the statement with pay stubs or tax returns for consistency.

4. Can fake bank statements be detected manually?

Yes, careful inspection can reveal inconsistencies. Checking formatting, and transaction details, and verifying personal information with other official documents can help detect fake bank statements.

5. Why do people create fake bank statements?

People falsify bank statements for various reasons such as:

- Securing loans or mortgages

- Meeting visa financial requirements

- Gaining approval for rental applications

- Misrepresenting business finances to attract investors

Final Thoughts

A fake bank statement can be difficult to spot, but by paying attention to formatting, transaction history, and document verification methods, you can protect yourself from financial fraud. The risks of using or accepting fake statements far outweigh any temporary benefits. When in doubt, always verify documents through official banking channels.

By following these guidelines, you can confidently detect fake bank statements and avoid falling victim to financial fraud.

If you have securely verified your bank statement and want to convert it in PDF to Excel format for more clarification, take advantage of convertbankstatement.io.