What is Bank Statement Verification? A Complete Guide

Bank statement verification checks if a bank statement is accurate. It involves cross-referencing the statement with bank records to confirm transactions and account details. It assists in the detection of fraudulent activities.

Income verification, identification of instances of fraud, and compliance with regulations are some of the areas in which banks, lenders, auditors, and corporate house owners utilize bank statement verification.

It plays a predominant role in safe financial decision-making since it gives reasonable assurance that the provided information is valid.

With advances in financial crimes, businesses tend to lean more on technology-driven solutions like bank statement verification software for faster and better delivery of the verification process.

Essential Checks for Accuracy of Bank Statements

A thorough verification process includes checking the following:

- Ownership Details: The statement should belong to the right account holder, with the name and account number matching official records.

- Transaction Integrity: Deposits, withdrawals, service fees, and interest payments must be valid and reflect actual banking activity.

- Data Accuracy: Balance, dates, and transaction history should align with other financial documents.

- Document Authenticity: Elements like bank logos, formatting, and security features must be consistent with genuine statements.

Bank statement verification is widely carried out by financial institutions, auditors, and fraud prevention departments to identify discrepancies, fight financial fraud, and ensure regulatory compliance.

Since bank statements are often used as proof of income, financial stance, or creditworthiness, it is important to verify the statements' authenticity. Without a proper check, manipulated or forged statements can lead to fraudulent transactions, inaccurate assessments, and financial loss.

For businesses, strict verification measures help maintain trust, minimize risks, and uphold regulatory standards.

Why is Bank Statement Verification Important?

A survey found that 69% of financial professionals expect financial fraud to increase. It demonstrates that bank statement verification plays a critical role in fraud prevention. Some key reasons include:

- Preventing Fraud: Identifying falsified statements, altered figures, or fake transactions.

- Confirming Income: Using bank statement verification to assess an applicant’s ability to repay loans.

- Validating Transactions: Ensuring financial records match actual transactions.

- Ensuring Compliance: Confirming compliance with anti-money laundering and customer regulations.

- Enhancing Audit Accuracy: Relying on verified bank statements to complete financial reports with confidence.

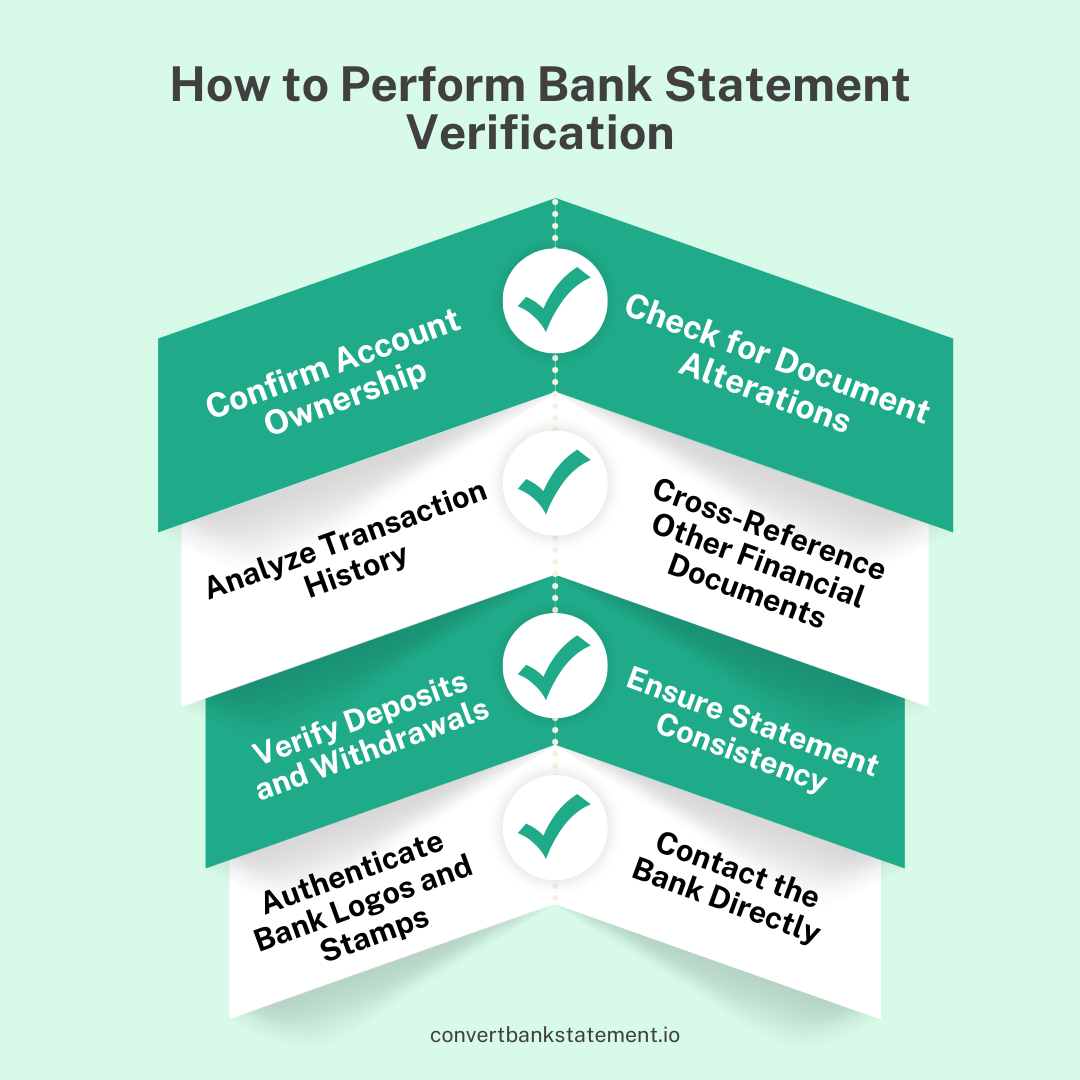

How to Perform Bank Statement Verification

Bank statement verification can be done manually or by using automated tools. Below is a step-by-step process to perform manual verification:

1. Confirm Account Ownership

The first step is to check whether the account details match the individual or business claiming ownership. Verify:

- Account holder’s name

- Account number

- Address and contact details

Discrepancies, such as misspelled names or mismatched numbers, could indicate fraudulent activity.

2. Check for Document Alterations

Fraudulent bank statements often have signs of tampering, such as:

- Inconsistent fonts, colors, or formatting

- Misaligned text or unusual spacing

- Poor print quality or pixelated logos

To affirm authenticity, request an official statement directly from the bank or use certified copies.

3. Analyze Transaction History

Carefully review transaction details to find the following:

- Unusual patterns (e.g., repeated round numbers)

- Large, unexplained deposits or withdrawals

- Inconsistent spending behavior

A deep analysis of financial transactions can reveal attempts at financial misrepresentation.

4. Cross-Reference Other Financial Documents

Compare the bank statement with other financial records such as:

- Tax returns

- Pay stubs

- Invoices and receipts

Mismatched figures between documents could indicate falsification.

5. Verify Deposits and Withdrawals

Validate all transactions have corresponding proofs, such as:

- Cleared checks

- Wire transfer confirmations

- Payment receipts

Any missing records should be investigated further.

6. Ensure Statement Consistency

Compare multiple consecutive bank statements to check for continuity:

- Matching the ending balance on one statement with the starting balance on the next

- Cross-checking for missing pages or unexplained balance changes

A break in the expected sequence can indicate potential tampering.

7. Authenticate Bank Logos and Stamps

Ensure official elements such as bank logos, watermarks, and stamps match the issuing bank’s records. Fake statements often contain incorrect branding details.

8. Contact the Bank Directly

If any discrepancies remain, verify the document with the issuing bank to confirm its legitimacy.

Modern Technologies for Bank Statement Verification

With increasing fraud risks, businesses are investing in advanced verification methods. The following are relevant technologies:

Optical Character Recognition (OCR)

OCR-based bank statement verification software helps to extract and analyze text from scanned statements for formatting troubles, spell-checking errors, and altered figures.

Artificial Intelligence (AI)

AI verification tools work on fingerprints for transaction patterns, find anomalies, and detect falsified documents.

Digital Forensics

Forensic tools can trace the edit history of digital bank statements that expose any unauthorized modifications.

Blockchain

Emerging blockchain solutions provide an immutable record of financial transactions by making falsification nearly impossible.

The Future of Bank Statement Verification

As the fraud method keeps on changing with the latest technology available, companies are now moving toward automated verification solutions. Research has stated that 74% of businesses are preparing to spend money on technology to identify financial fraud. The use of bank statement verification software increases security, whereas the speed, reduced errors, and manual effort come as added benefits.

Conclusion

The bank statement verification process is vital for financial institutions, lenders, and auditors. It creates a financial integrity system that blocks fraud and improves compliance with banking regulations, whether it is done manually or by automated tools.

Investing in bank statement verification software has become a must for any business concerned with large volumes of financial data. As technology improves, its application will facilitate the verification, thereby checking corruption in many financial deals by firms.

FAQs About Bank Statement Verification

What does bank statement verification mean?

The bank statement verification means to ensure that it is authentic and unchanged and the account's recorded financial activities are presented accurately.

How do I check bank transactions?

Verify the transactions against the cleared checks, wire transfers, deposit receipts, etc.

What are the red flags in a bank statement?

Check for mismatched fonts, blurred texts, altered logos, and transaction amounts suspiciously rounded. Businesses and individuals can perform their due diligence to protect themselves from fraudulent activities by employing these best practices.