Bank Reconciliation Statement: Advantages and Disadvantages

Each year, businesses lose about 5% of their total income because of accounting errors. This alarming statistic emphasizes the importance of bank reconciliation statements, which are important but often neglected.

In this blog post, we'll explain the advantages and disadvantages of bank reconciliation and real-life advice for maximizing benefits while eliminating challenges.

What is a Bank Reconciliation Statement?

The bank reconciliation statement (BRS) defines the financial comparison between your internal cash records and a bank statement. It thus discovers differences that arise from timing differences such as outstanding checks, errors, or even fraud.

Think of it as a very informative "finance fact-check" whereby every transaction gets verified to align with the other across both records.

Why is Bank Reconciliation Important For a Business?

Bank reconciliation is not a chore or an administrative activity. It protects financial assets. Suppose businesses do not reconcile their bank statements. In that case, they can easily work under a false premise concerning their financial position, resulting in cash flow problems, overdraft situations, or unnoticed fraud.

It also helps businesses by regularly reconciling upstream accounts against bank transactions.

Companies can catch early errors, unauthorized withdrawals, or even recorded fees before unmanageable problems build. Aside from finding errors, reconciling acts as an important tool in the financial planning process.

Outdated balance figures cause a business's budgeting to run into complications. Proper reconciliation ensures that the reported cash balance indicates the amount available, thus enabling businesses to make decisions on their financial matters more efficiently.

How Often Should a Bank Reconciliation Statement Be Completed?

The frequency of reconciliation depends on the size and nature of the business. For small businesses with low transaction volumes, monthly reconciling (in sync with bank statements) may be sufficient.

However, companies processing hundreds of transactions daily, such as retail stores or e-commerce businesses, should consider weekly or daily reconciliations. More frequent reconciliations make early detection of issues possible.

For instance, if a charge is recognized as fraudulent a couple of days after a transaction, it can be disputed, potentially preventing financial loss. If a company has cash flow problems, frequent reconciliations prevent overdrafts.

Finding the right balance improves efficiency. It also allows a comprehensive view of the financial area without overburdening accounts with excessive work.

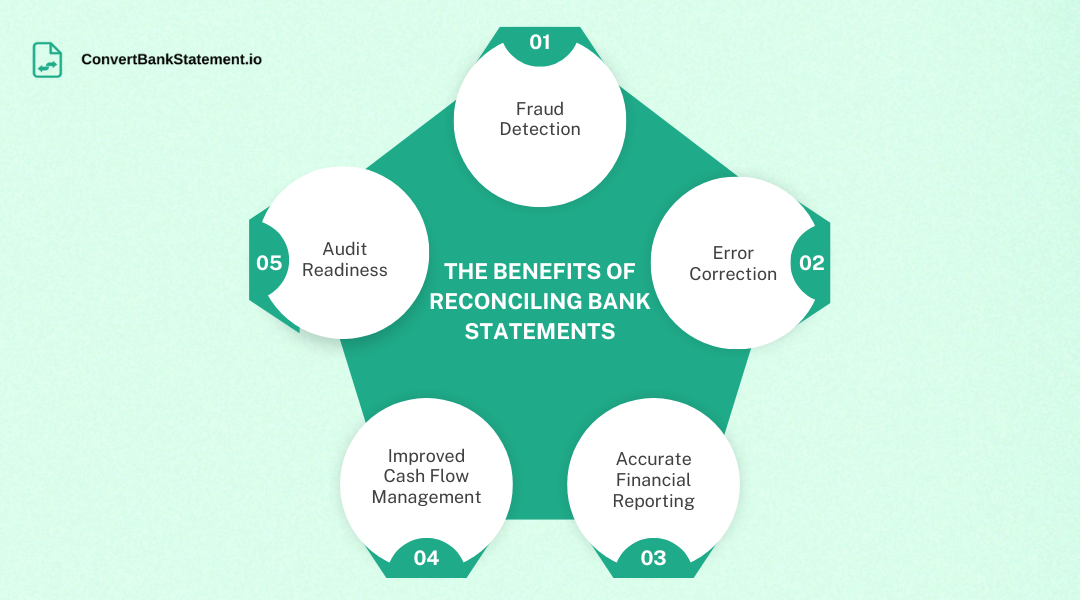

The Advantages of Reconciling Bank Statements

Regular reconciliation isn't just a compliance checkbox; it's a strategic benefit. Here are the reasons.

1. Fraud Detection

Unauthorized transactions, altered checks, or internal embezzlement can cripple a business. By reconciling accounts monthly, you can pick up any irregularities immediately.

A situation where a $1,500 vendor payment is incorrectly recorded as $15,000 can be identified during reconciliation. This assists a business in preventing cash flow disruptions. Automation also improves detection by identifying the anomaly in real time.

2. Error Correction

The banking system is not perfect. Some tiny errors, such as a misplaced decimal, duplicate payment, or an unrecorded fee, could paint a slightly distorted picture of your financial situation. Reconciliation catches those errors early.

For example, a check cleared for $470 was logged as $370. This error became clear during reconciliation.

3. Accurate Financial Reporting

Investors and lenders require accurate information. By keeping account of deposits in transit, outstanding checks, and bank fees, reconciliation confirms that your balance sheet reflects reality.

For instance, a $20,000 deposit missing from your bank statement would inflate your books without reconciliation.

4. Improved Cash Flow Management

Knowing your correct cash position prevents overdrafts and optimizes liquidity. A retail business, for example, can avoid a $300 overdraft fee by spotting an unprecedented check during reconciliation.

5. Audit Readiness

Auditors scrutinize reconciled accounts. A clean bank reconciliation statement simplifies compliance and builds trust with stakeholders. Automated systems generate audit trails and reduce preparation time by 30%.

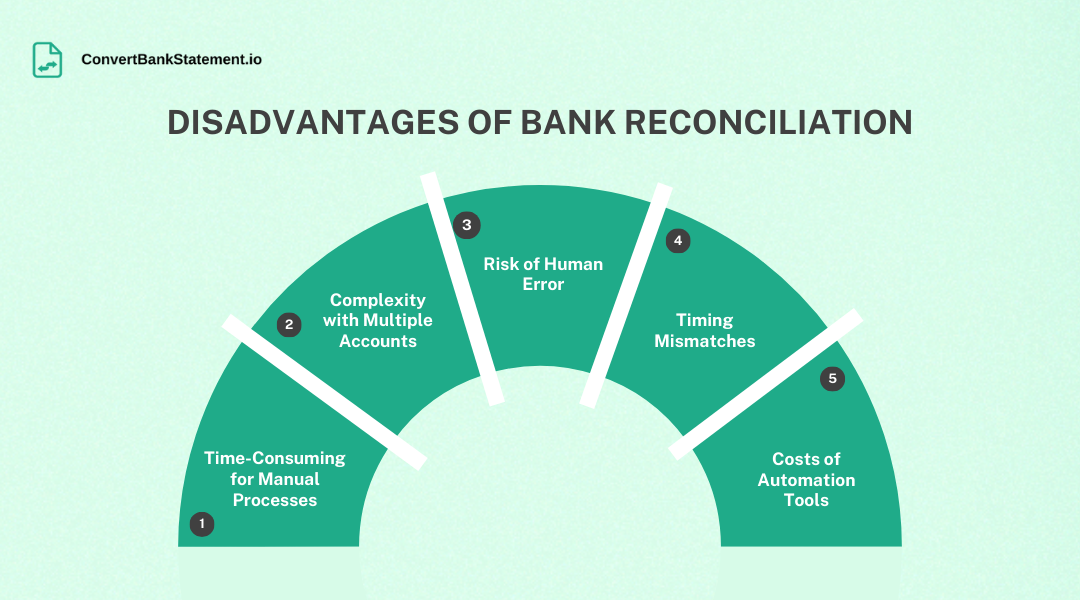

Disadvantages of Bank Reconciliation

1. Time-Consuming for Manual Processes

Small businesses with 500+ monthly transactions spend 8–10 hours monthly on manual reconciliation. For multinationals, this issue escalates exponentially, diverting resources from strategic tasks.

2. Complexity with Multiple Accounts

Businesses using several banks face reconciliation chaos. A single missed transaction in one account can cause errors across financial statements.

3. Risk of Human Error

Manual data entry invites mistakes. A study found that 18% of reconciliation discrepancies stem from misclassified transactions.

4. Timing Mismatches

Checks lingering in transit create confusing cash flow projections. A $2,500 check delayed by a vendor, for instance, may falsely inflate your ledger balance.

5. Costs of Automation Tools

While software reduces errors by 95%, upfront costs deter small businesses. However, the long-term ROI in saving time and preventing fraud often justifies the investment.

Best Practices to Maximize Benefits

1. Automate Relentlessly

Tools like Solvexia or QuickBooks auto-match transactions, and slash processing time by 90%. Real-time dashboards highlight discrepancies instantly.

2. Reconcile Frequently

Daily or weekly checks prevent error pile-ups. One firm can reduce fraud losses by 40% after switching from monthly to daily reconciliations.

3. Segregate Duties

Assign reconciliation to someone independent of cash handling. This internal control reduces fraud risk.

4. Document Everything

Maintain logs of adjustments, voided checks, and NSF transactions. Cloud-based systems like Xero auto store records for audits.

5. Train Your Team

Educate staff on reconciling tools and red flags (e.g., unexpected fees). A well-trained team resolved 80% of discrepancies without IT support.

Conclusion:

Bank reconciliation is a double-edged sword: its benefits, fraud prevention, accuracy, and compliance, far outweigh the drawbacks of time and complexity, especially with automation. Reconciliation isn’t just about balancing numbers; it’s about safeguarding your business’s future.

By adopting modern tools and proactive practices, you’ll turn reconciliation from a tedious task into a cornerstone of financial stability.