Certified Bank Statement: What It Is and How to Get One

A certified bank statement is a document issued with a signature and/or stamp verification from your own bank to show its authenticity. This is required as proof of legal formalities for applications for visas, loans, and official documents.

What is a Certified Bank Statement?

A certified bank statement is a standard bank statement that has been authenticated by a bank official. This authentication typically involves the bank adding its stamp and an authorized signature to verify that the information on the statement is accurate and legitimate. Unlike regular statements available online or through banking apps, a certified bank statement carries additional weight in official processes.

Why Might You Need a Certified Bank Statement?

You may need a certified bank statement when you have to validate your stability in terms of finance, especially for situations that may need proof that the account records presented are valid. You are required to present certified bank statements in several situations where you have to prove your financial stability or transaction history.

Such situations usually require higher verification, and a certified statement ensures the bank's endorsement of the accuracy of your financial records. Some common situations include:

- Loan Applications: In loan applications, financial institutions demand certified statements regarding your income, spending patterns, and overall financial health.

- Visa or Immigration Processes: Most embassies or immigration authorities ask for certified bank statements as part of the visa application process. This statement proves to them that you have enough money to sustain yourself during your stay in another country.

- Proof of Funds: For the purpose of buying real estate, admissions to colleges, or business needs, certified statements from banks become formal proof of your money available.

- Legal and Tax Purposes: In case of disputes or audit/court cases, certified statements from banks could be proven as evidence confirming your activities financially, like transactions, balance in the accounts, and other related matters.

- Opening of accounts or other financial transactions: Some banks or financial institutions require you to present a certified statement whenever you want to open new accounts.

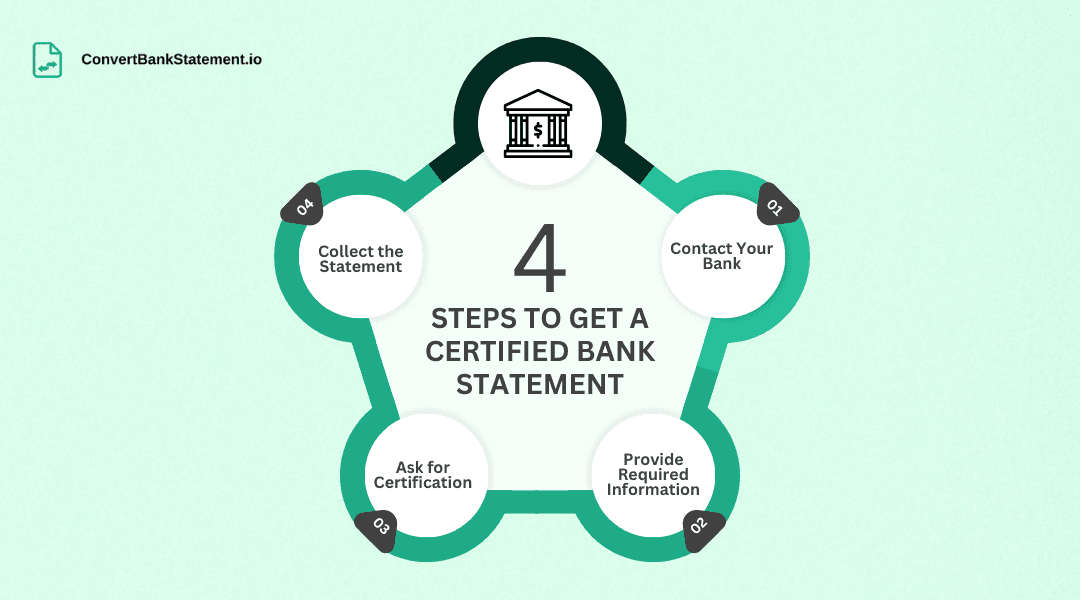

Getting a Certified Bank Statement

In a nutshell, getting a certified bank statement entails a few rather simple steps. Here is how you can successfully navigate the whole process and secure the document needed without undue delays.

1. Contact Your Bank

The first part is going to the bank or even contacting the customer service of your bank to inquire how they normally proceed with their process of certifying the bank statement. Different banks have different policies and procedures in place, and some of them may also offer online services where you can request the document as well.

2. Provide Required Information

Ensure you have all the information required before you approach the bank. If you’re starting the process online, ensure you’ve already downloaded your digital bank statement before requesting certification.

You would need to provide your account number, type, and all other identification details requested to ensure that the bank knows which account statement you are requesting.

Indicate the time frame for which you require the statement. For instance, you might require the statement for the last 3 months, 6 months, or any particular date range.

3. Ask for Certification

Once you have provided the required information, ask the bank to certify your statement. In most cases, this involves the signature or stamp of an authorized bank official, who verifies that the document is genuine.

Sometimes, you are also required to fill out more forms or even submit a formal request to obtain this service.

4. Collect the Statement

Once your request is processed, the certified bank statement will either be ready for pickup or you will have to go there later to claim it. Some banks may also offer to mail printed bank statements to your address, depending on your request.

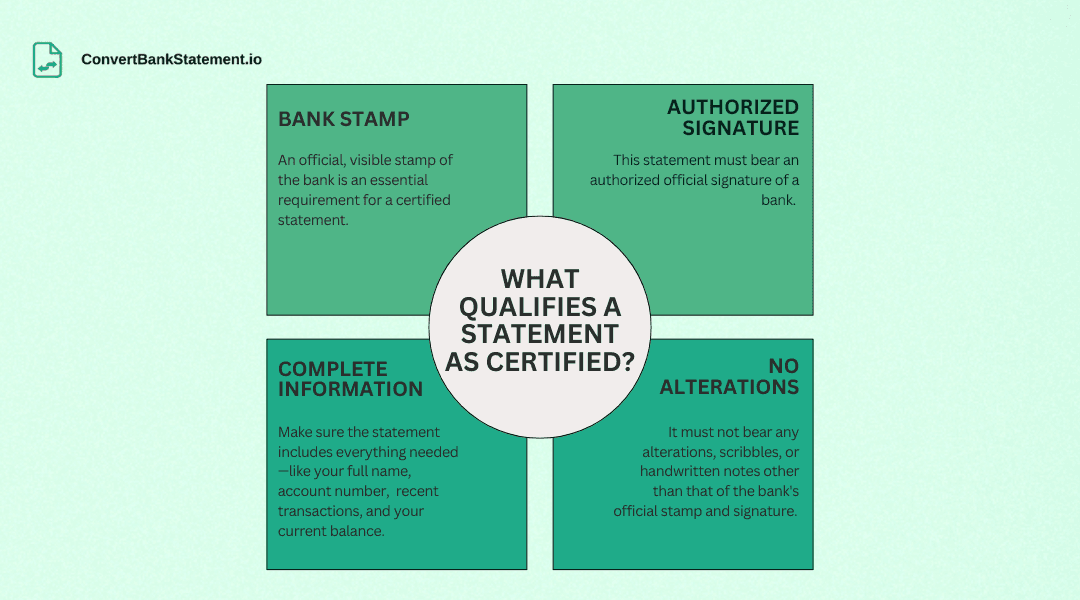

What Qualifies a Statement as Certified?

A certified bank statement should qualify for the following requirements:

- Bank Stamp: An official, visible stamp of the bank is an essential requirement for a certified statement. The stamp of the bank shows that the bank has authenticated the statement.

- Authorized Signature: This statement must bear an authorized official signature of a bank. Such a signature is a certification that the information appearing in this statement has indeed been checked by the bank and is, therefore, accurate.

- Complete Information: Make sure the statement includes everything needed—like your full name, account number, a list of recent transactions, and your current balance (so nothing’s missing!).

- No Alterations: It must not bear any alterations, scribbles, or handwritten notes other than that of the bank's official stamp and signature. It ensures the completeness of the document and eliminates any scope of tampering.

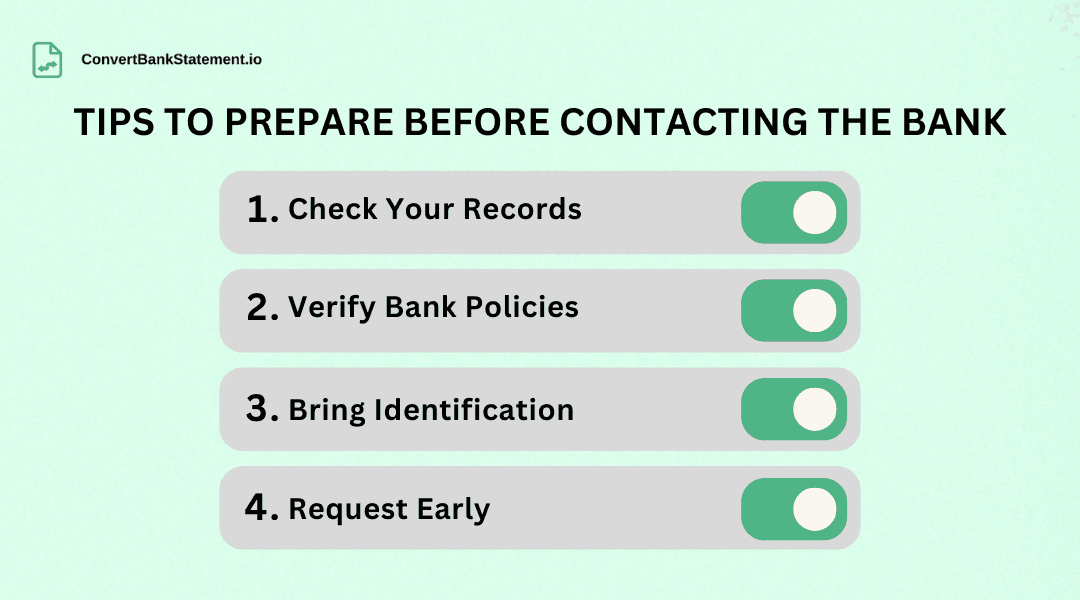

Tips to Prepare Before Contacting the Bank

There are a few things you can do beforehand to make the process as efficient as possible. This will help you avoid any delays or complications.

- Check Your Records: You should double-check your bank account details and be sure of the time period for which you are requiring the statement.

- Verify Bank Policies: The process of certification of statements differs from bank to bank. In some banks, you will need to fill a specific form, while other banks will request other documents meant for verification purposes.

- Bring Identification: Be prepared to have a valid form of identification on hand when making a request for your certified bank statement. Identification forms include mainly a passport, driver's license, or even a national ID card.

- Request Early: If you are in a time constraint because you require the certified statement for a deadline, then make the request way before time.

Conclusion:

A certified bank statement is a crucial document in various official and legal processes. Whether for applying for a loan, processing a visa, or proving your financial stability, this document serves as reliable proof of your financial history. By understanding the certification process and preparing accordingly, you can easily obtain a certified bank statement whenever you need it.

Once you have your certified bank statement, organizing it in different formats like Excel (XLS) or CSV can make analysis or record-keeping more efficient for you.